Product Design | Design Systems

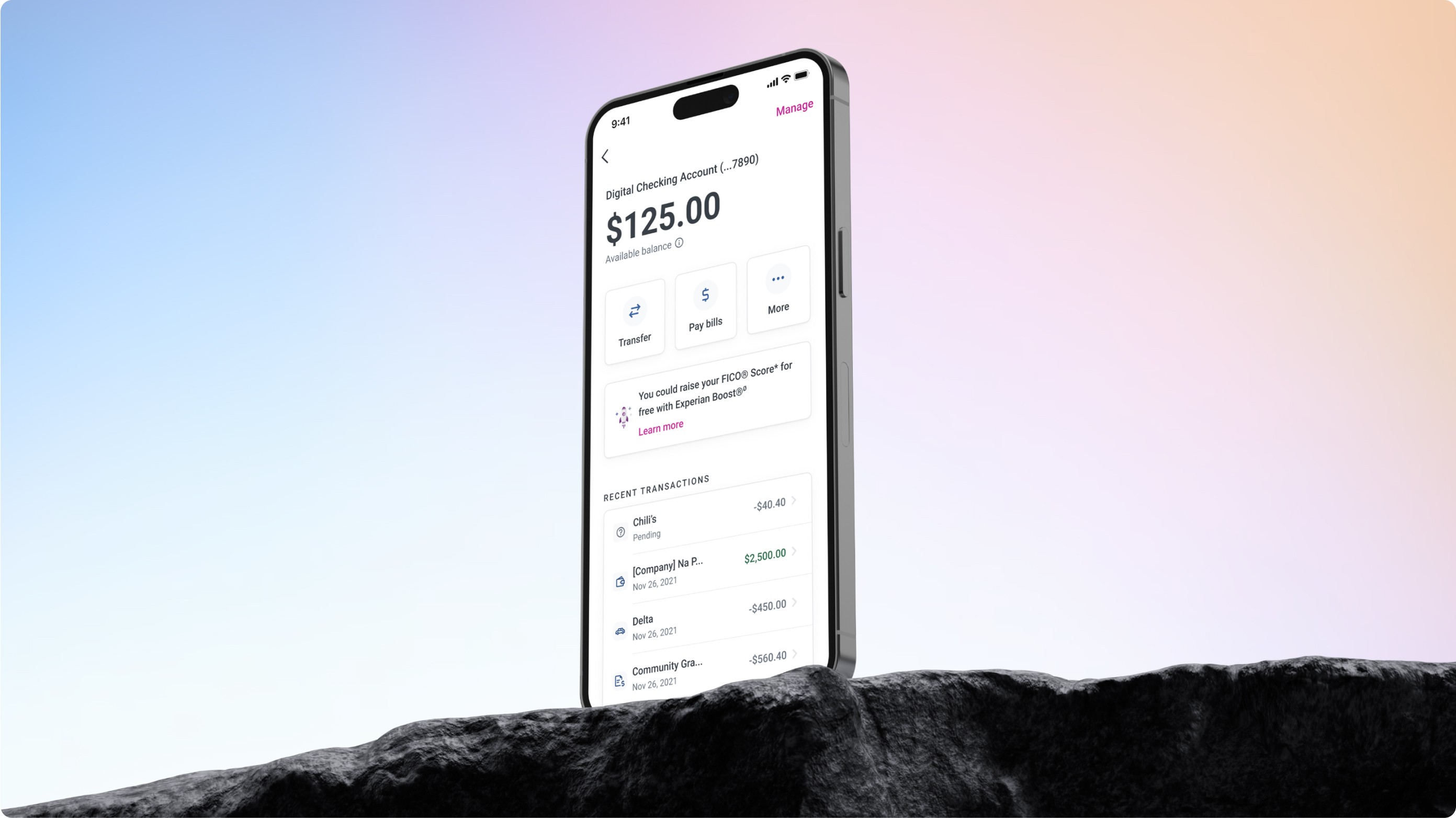

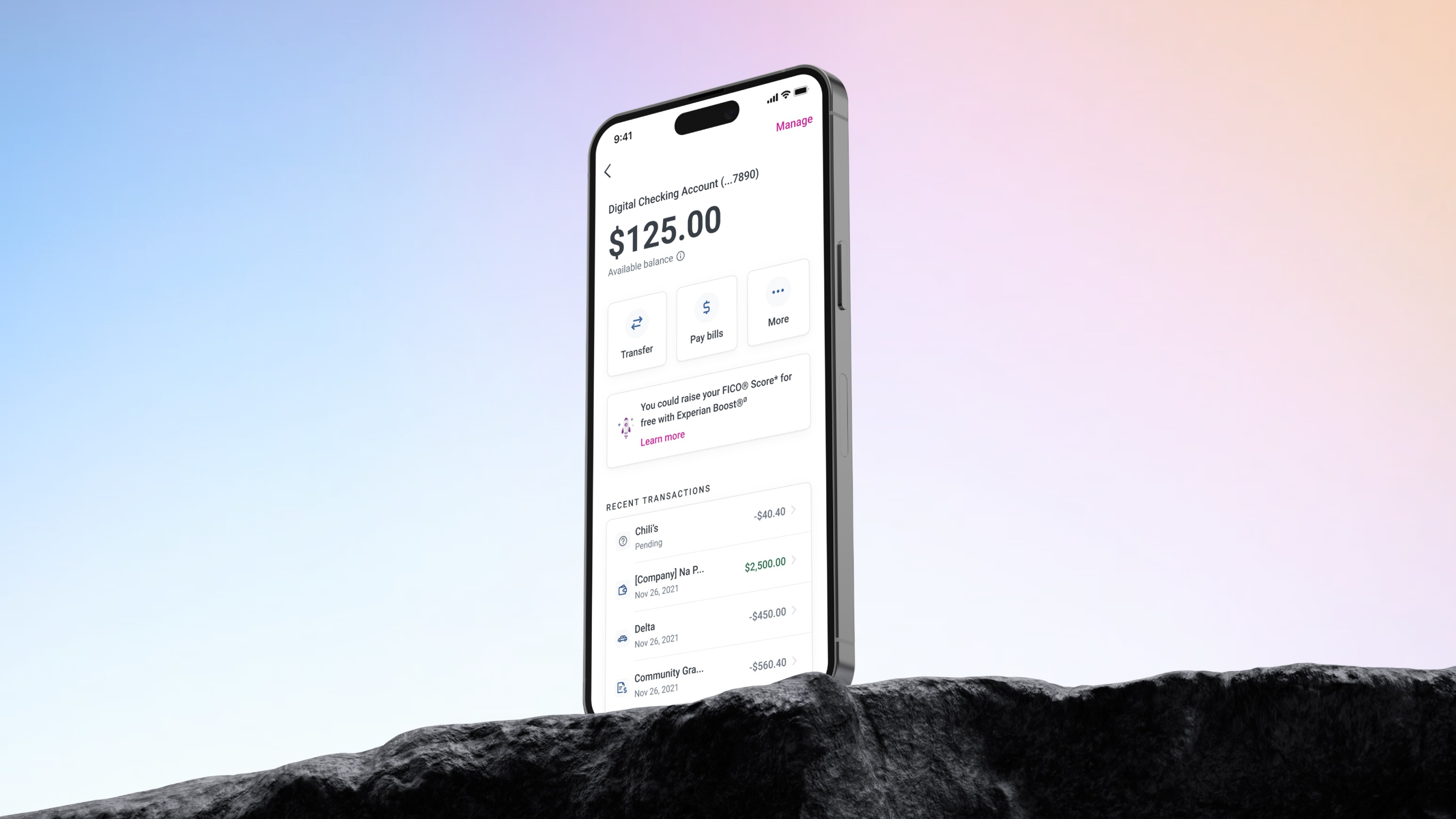

Experian Smart Money

Project details

Experian, a leading American credit bureau with over 220M U.S. consumers, set out to expand its services by launching a digital banking app. Our mission was to simplify banking and empower individuals to manage their finances effectively, boost their credit scores, and achieve financial confidence through their everyday purchases.

I contributed by designing the Onboarding and Direct Deposit flows and supporting the Design System.

Client

Experian

My role

Design system

Prototyping

Interaction Design

Developer handoff

Team

6 designers

1 project manager

Duration

2022 - 2023

Status

Launched

Confidential project (NDA)

Due to project confidentiality, I’m unable to share full project details or process. Please email me if you'd like to chat more about my design process :)

HIGHLIGHTS

An onboarding experience seamlessly connecting to Experian’s pre-exiting ecosystem

An onboarding experience seamlessly connecting to Experian’s pre-exiting ecosystem

I crafted an onboarding experience that guides users through multiple screens without feeling overwhelming, using playful and strategic design choices to keep them engaged.

By focusing on clarity, guidance, and intuitive flows, I helped ensure first-time users could navigate the product confidently and stay engaged from start to finish.

I crafted an onboarding experience that guides users through multiple screens without feeling overwhelming, using playful and strategic design choices to keep them engaged.

By focusing on clarity, guidance, and intuitive flows, I helped ensure first-time users could navigate the product confidently and stay engaged from start to finish.

HIGHLIGHTS

Incentivizing direct deposit and exploring integration with third party applications

I designed features that encourage users to set up direct deposit by highlighting tangible benefits and rewards, while also exploring ways to integrate with third-party applications for a smoother, more connected experience. This approach aimed to drive adoption, reduce friction, and make financial management more seamless for users.

HIGHLIGHTS

Incentivizing direct deposit and exploring integration with third party applications

I designed features that encourage users to set up direct deposit by highlighting tangible benefits and rewards, while also exploring ways to integrate with third-party applications for a smoother, more connected experience. This approach aimed to drive adoption, reduce friction, and make financial management more seamless for users.

HIGHLIGHTS

Building on and enhancing the design system to optimize for future capabilities

I helped grow Experian’s design system by introducing new components suited to our use cases, while keeping them consistent with the existing framework across platforms. This taught me how to balance leveraging a strong foundation with adding thoughtful extensions to address evolving needs.

HIGHLIGHTS

Building on and enhancing the design system to optimize for future capabilities

I helped grow Experian’s design system by introducing new components suited to our use cases, while keeping them consistent with the existing framework across platforms. This taught me how to balance leveraging a strong foundation with adding thoughtful extensions to address evolving needs.

Our impact

$50M

added in annual revenue within the first year of the apps introduction

Source

$50M

added in annual revenue within the first year of the apps introduction

Source

22M

of Experian's 220 million U.S. customers have transitioned to using Smart Money, in less than two years

Source

22M

of Experian's 220 million U.S. customers have transitioned to using Smart Money, in less than two years

Source

14M

users already using Experian Boost since launch

Source

14M

users already using Experian Boost since launch

Source

Project takeaways

Project

takeaways

Navigating Edge Cases

I learned to anticipate and address edge cases early in the design process, as they often reveal unexpected user behaviors or scenarios that can impact the overall product experience.

Adapting to Changing Requirements

Working with evolving requirements taught me the importance of flexibility, especially with tight timelines. Close collaboration between design and development was key, as designs needed to quickly adapt to new requirements as they were finalized.

Working Within Design Restrictions

Experian's established design system provided a robust framework, but I learned how to balance using existing components with proposing new ones that aligned with the overall system across multiple platforms.

Ensuring Scalability Across App and Desktop

Designing for both app and desktop highlighted the different requirements for each. I gained valuable insight into how features scale across different platforms, ensuring a consistent user experience despite varying technical constraints.

Get in touch

Avg. response 24 hours

Nicole — Lozano

Designed with love © 2025

Nicole — Lozano

Designed with love © 2025

Nicole — Lozano

Designed with love © 2025

Menu

Menu

Project takeaways

Navigating Edge Cases

I learned to anticipate and address edge cases early in the design process, as they often reveal unexpected user behaviors or scenarios that can impact the overall product experience.

Adapting to Changing Requirements

Working with evolving requirements taught me the importance of flexibility, especially with tight timelines. Close collaboration between design and development was key, as designs needed to quickly adapt to new requirements as they were finalized.

Working Within Design Restrictions

Experian's established design system provided a robust framework, but I learned how to balance using existing components with proposing new ones that aligned with the overall system across multiple platforms.

Ensuring Scalability Across App and Desktop

Designing for both app and desktop highlighted the different requirements for each. I gained valuable insight into how features scale across different platforms, ensuring a consistent user experience despite varying technical constraints.

Our impact

$50M

added in annual revenue within the first year of the apps introduction

Source

22M

of Experian's 220 million U.S. customers have transitioned to using Smart Money, in less than two years

Source

14M

users already using Experian Boost since launch

Source